The Atlanta real estate market remains strong despite the rates. We now have two full years of data since the rates jumped, two spring markets to review. While the expected drop in numbers occurred, values have not missed a beat. To be fair, the "metro Atlanta" region is far to large and diverse to paint with one brush. However, this data is useful in providing a good indicator of macro trends. Every submarket is different, as is every type and price point. Success is found by working with skilled professional agents, not some hobby hack agent with ten other side hustles. Below is a review of the six major metro counties and all price points.

occurred, values have not missed a beat. To be fair, the "metro Atlanta" region is far to large and diverse to paint with one brush. However, this data is useful in providing a good indicator of macro trends. Every submarket is different, as is every type and price point. Success is found by working with skilled professional agents, not some hobby hack agent with ten other side hustles. Below is a review of the six major metro counties and all price points.

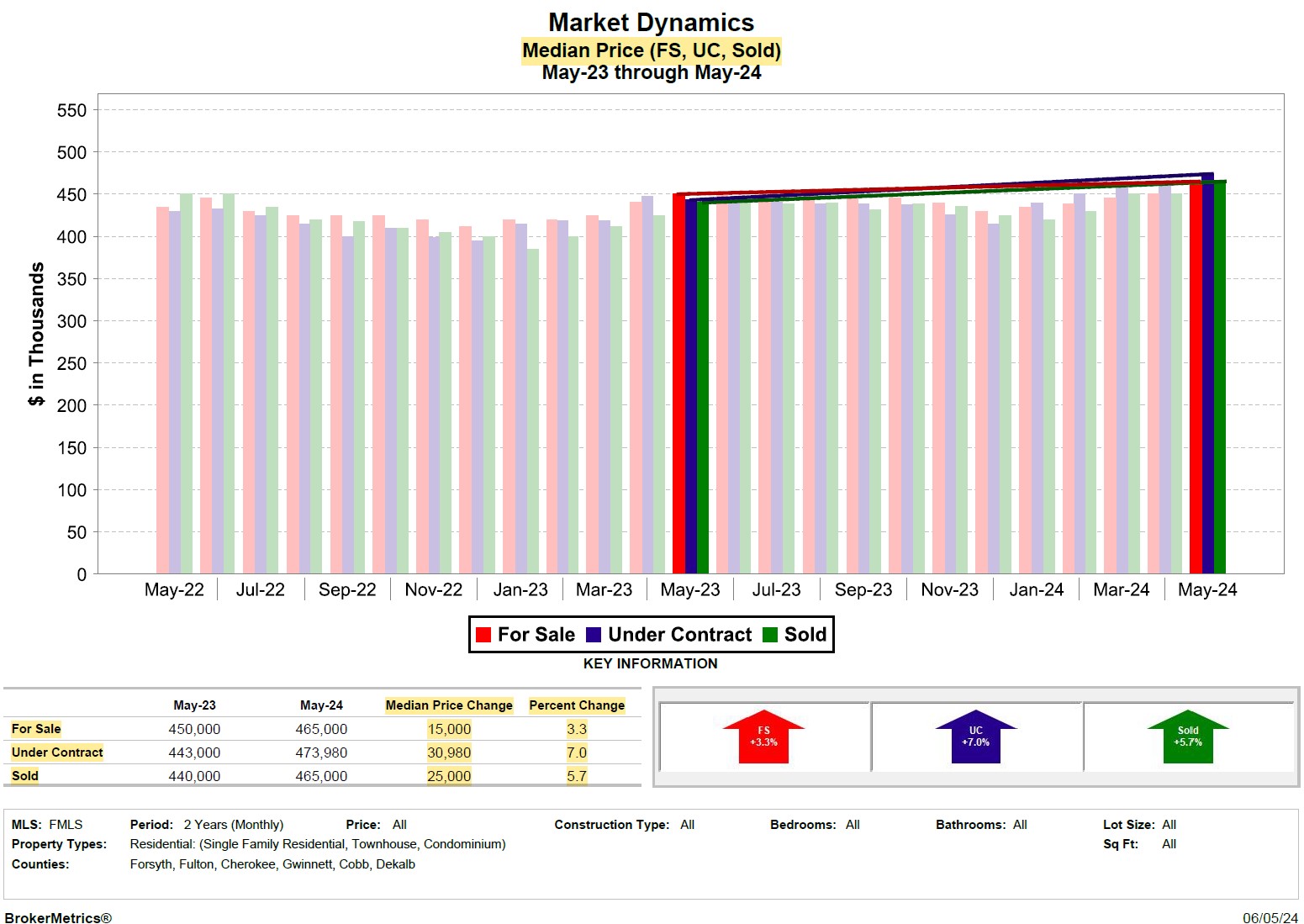

Atlanta Home Prices Are Still Increasing

Higher interest rates are not slowing home appreciation in Atlanta. While the market has the expected ebb and flow, 2YOY and YOY, sale prices have increased 3.3% and 5.7%. Buyers adjusted over 2023 and into early 2024, they are acclimating to life in the 7% range.

Prices continue to climb. Sale prices are rising but at a much more reasonable rate than before the rate bump. Sellers stayed a bit over optimistic as rates rose but have started to acknowledge market changes over the last year. We are seeing markets that continue to have very stiff competition, over list offers and significant buyer concessions. Conversely, we have markets where things have balanced; where marketing times have increased and competition has normalized. Everything is hype local.

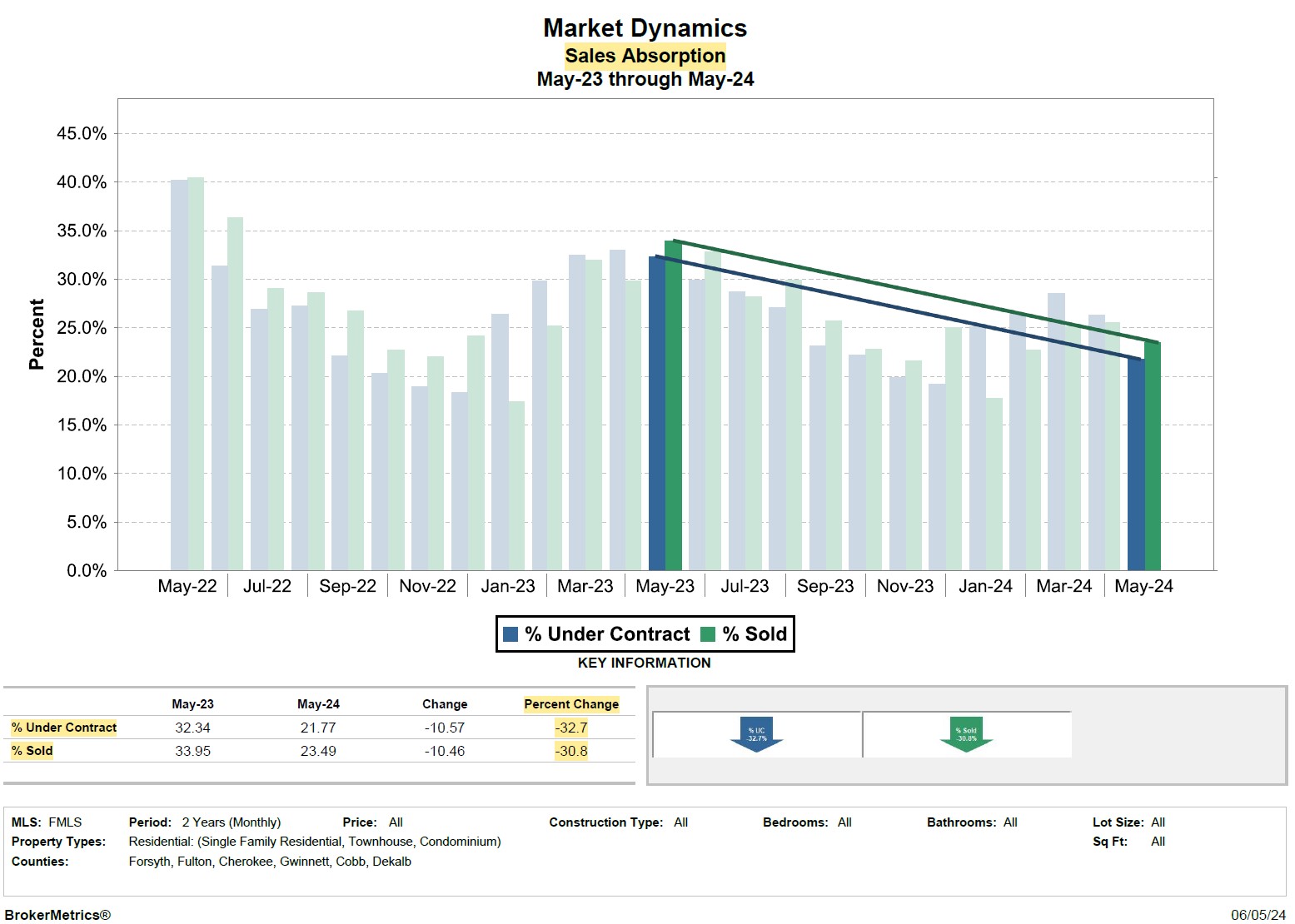

About 23% of Atlanta Home Listings Sell

This is an easy way to describe the impact of rate hikes. In May '22 as rates started to jump, just over 40% of sellers found buyers. Over the next two years, that number would drop to a low of about 18% for homes closing and 19% for homes going under contract.

In May 2024, 21.77% of Atlanta homes for sale were under contract and 23.49% closed. These numbers are well below the peaks of the last two years, a direct result of the economy and interest rate bump. In each of the last two years, we see the spring peaks mainly in the March/April time frame. While the data for June remains to be seen, this trend is likely to continue. There are a number of reasons, he reduced buyer pool and rates the most obvious. However, the "aspirational" seller that refuses to acknowledge the data is always present as are agents that chose to tell sellers whatever they want just to get a listing. The recent "commission lawsuit" dust up is also going to impact things, how exactly remains to be seen.

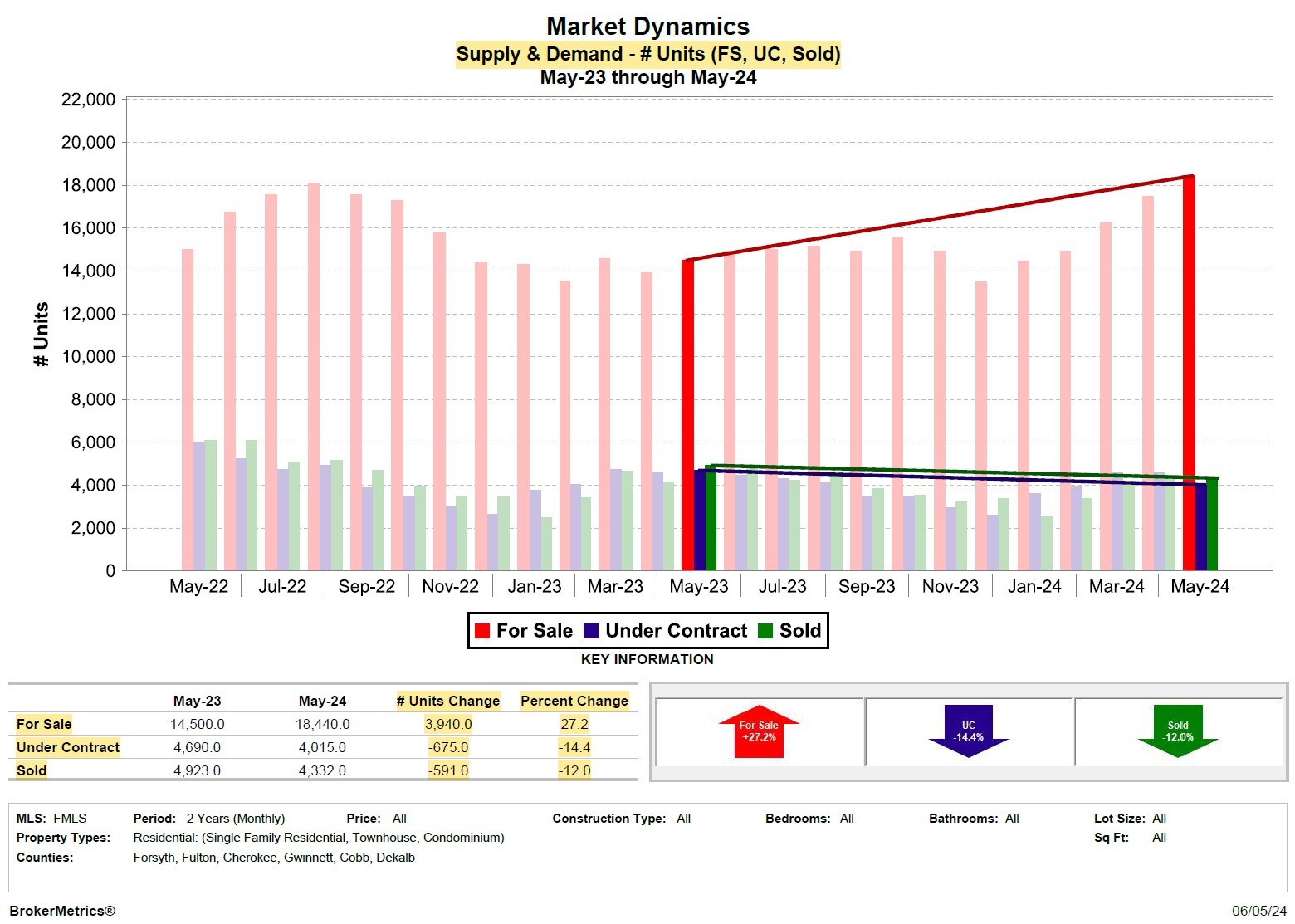

Atlanta Housing Inventory Increases

Inventory of homes for sale around Atlanta continues to rise. Interest rates froze the market two years ago with drastically fewer contracts and closings. Over the last year, both still dropped but at a slower rate as buyers adjusted to the rates. Sellers continue to think "yeah but my home..." and that approach can backfire into a listing that stagnates and sits on the market. Fewer and more disciplined buyers means that sellers also have to adjust.

Over the last two years, both contract and closings are lower. There was improvement this year as buyers acclimatize to the rates. The Spring markets are always the busiest and we see it again. Every market has the "normal" listing inventory due to life changes. Atlanta remains busy with corporate relocation and as the post pandemic economy shakes out more companies are going back to office policies. This market is not seeing any distressed or foreclosure activity, unlike the 09-10 crash sellers are financially secure. Given all of the economic turbulence, none of these numbers are surprising.

How's the Market?

The Atlanta real estate market is just fine. We're seeing pockets where stiff competition remains and we're seeing pockets where balance is in place. We are not seeing any strong buyer markets at this time nor are we seeing any areas with falling prices. Remember, real estate must be viewed over at least a quarterly run to allow time for patterns to develop. The Atlanta market is settling into - returning to - the predictable patterns we saw prior to pandemic. Of course there are a number of macro variables that cannot be controlled - the economy, inflation, global conditions as well as those on the local level - economy, area growth, local politics. This being an election year adds a cherry on top, never forget that working with a seasoned pro the single best thing you can do if buying or selling a home is in your future.

Posted by Hank Miller on

Leave A Comment