Joey sums up the 2025 Greater Atlanta housing market at the half year mark. Q1'25 was a dud, one of the slowest quarters of the last several years. Then April said, "hold my beer", it was one of the quietest months in memory. Fortunately, the market quickly woke up (as the economy settled) and the Atlanta market got back to business in May.

was one of the quietest months in memory. Fortunately, the market quickly woke up (as the economy settled) and the Atlanta market got back to business in May.

As we stand right now (Early July 25), we're calling the "Greater Atlanta" real estate market balanced. The market is not going to to crash, prices will be generally stable moving forward, rates likely remain 6%-6.75%, and everyone needs to remember what "balanced" is. For buyers - it's not like post crash fifteen years ago, you are not successful offering 35% under list. For sellers - it's not the '21-'22 buyer frenzy; list prices must be reasonable.

Before we get to the charts - please remember CONTEXT. The Atlanta market is one of the strongest in the nation. also one of the largest. The mainstream media lives on click bait headlines, ignore them. Atlanta real estate is not in, and will not be in, distress. Some areas will do better than others, every micro market is different. Some sellers will not be happy, buyers that didn't listen during the post pandemic craziness...they might take a pop. But for those that used their heads (and professional agents), we don't see any cause for concern.

The charts consider Q2'25 vs Q2'22 - the long 3 year view. The bullet points consider Q2'25 vs Q2'24 - the shorter YOY view.

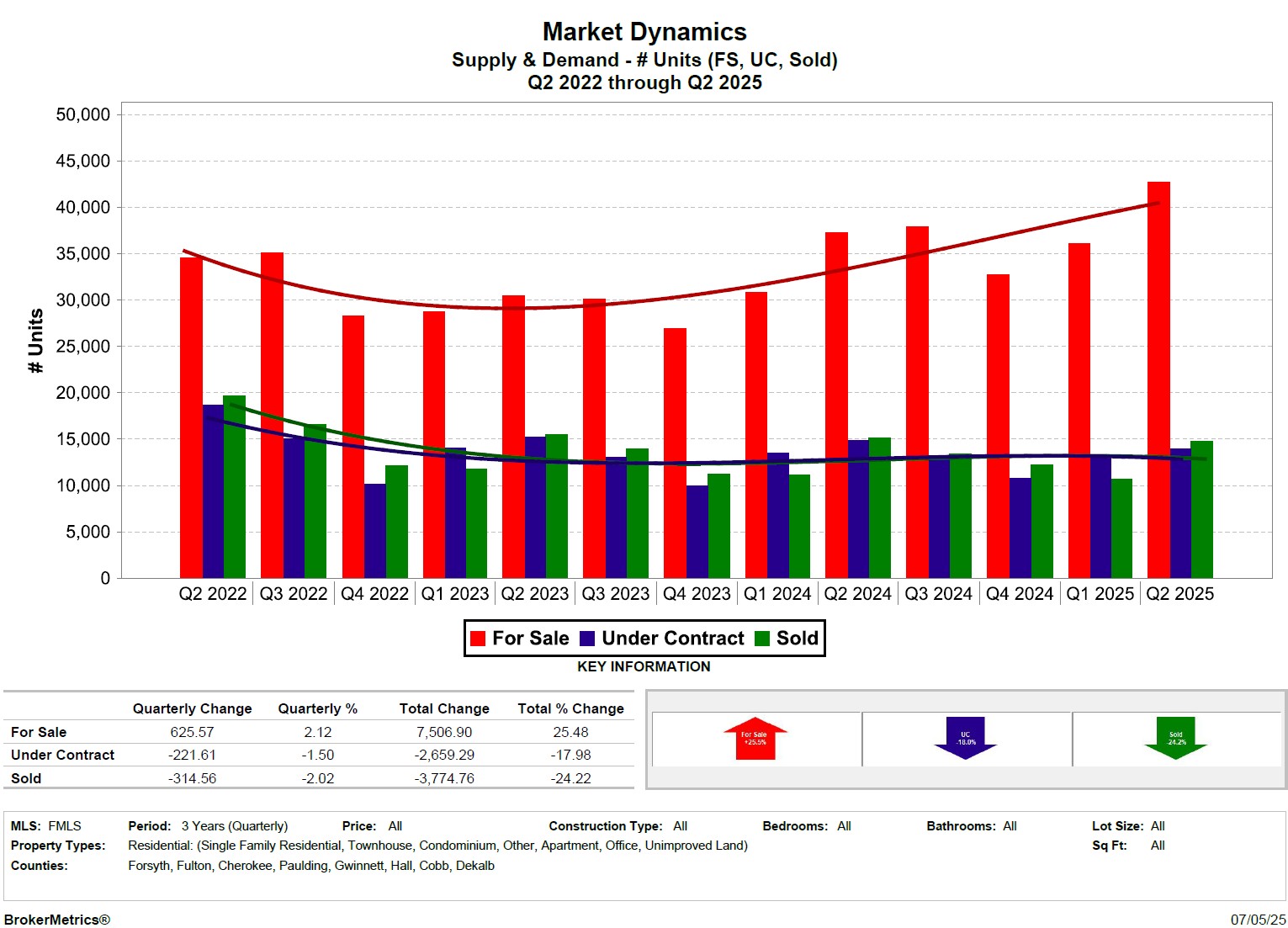

Atlanta Real Estate Market Inventory

- Active listings totaled 42.7K+- which is a +10.24% YOY bump from Q2'24

- Listings are the highest over the last three years - but BELOW pre-pandemic levels

- Contracts and closings are down, but closing esp picked up for Q1'25

- Context - the Q1'25 funk ended, Q2'25 contracts and closings snapped back

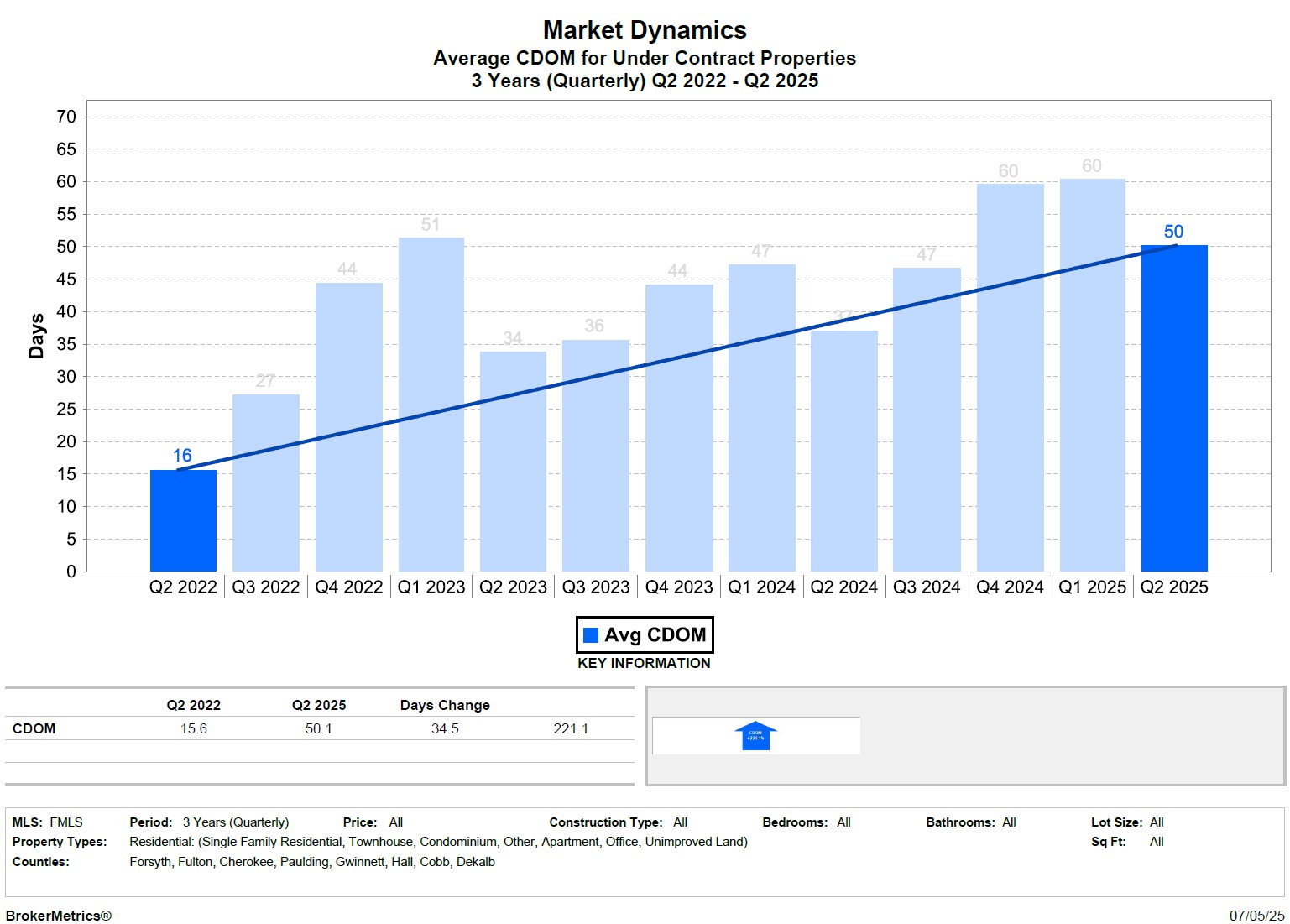

Days on Market for Greater Atlanta Homes

- Steady climb into the "normal" DOM of 60-120 days

- Q2'25 shows the expected spring drop, this figure remains lower than pre-pandemic levels

- Aspirational sellers, sellers exploiting the spring market, hesitant buyers, are factors

- Context - not alarming, steady rise but well within normal range, Q2 dropped as expected

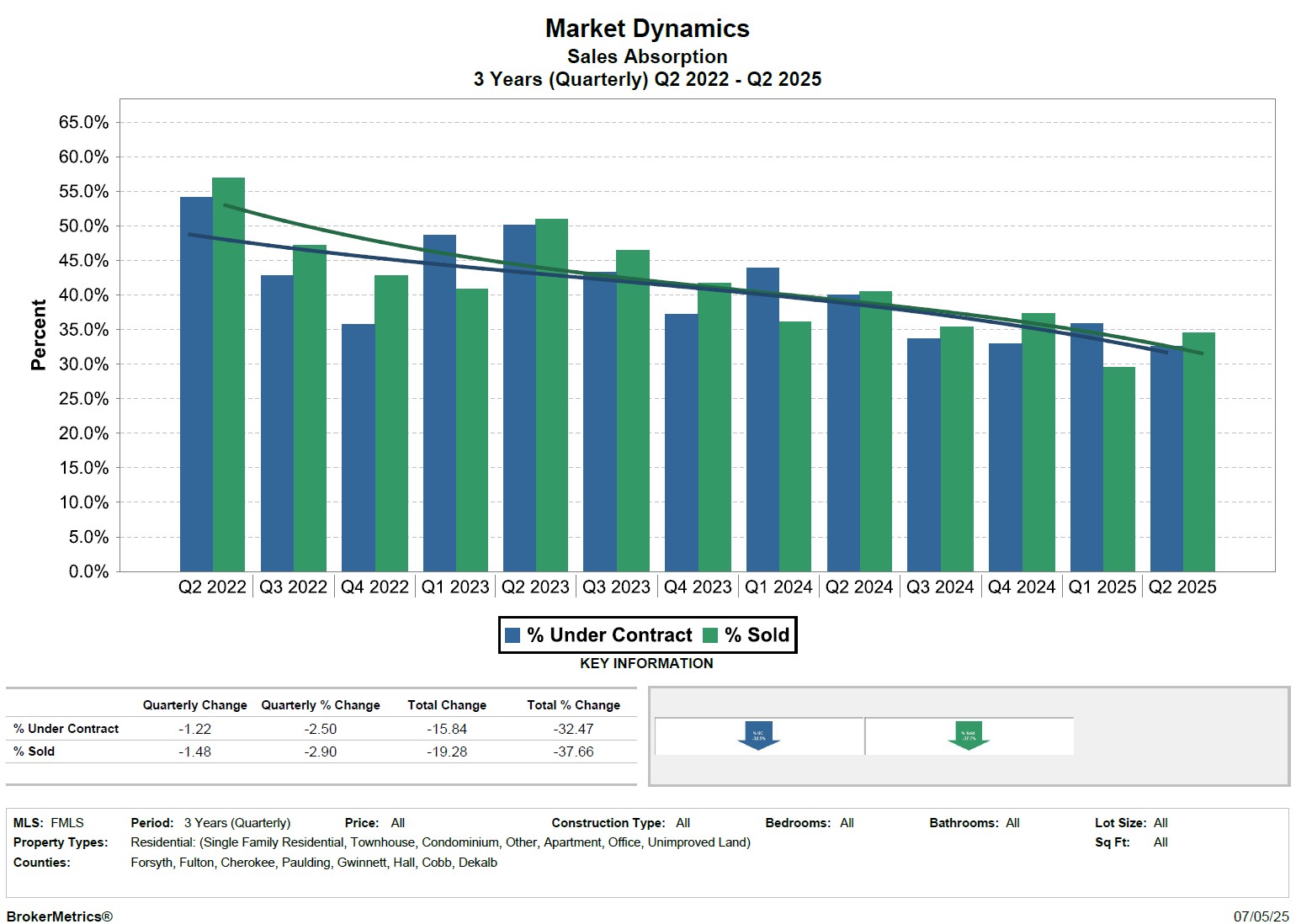

Absorption Rates of Homes in Atlanta

- In Q2 '25, contracts and closings were close to the lows of the last three years

- Contracts increased from the last half of '24

- Q1'25 saw 33.69% of listings contract, 28.56% of listings close

- Context - "balanced" is a 10%-20% closing rate, below 10% favors buyers and above 20% favors sellers

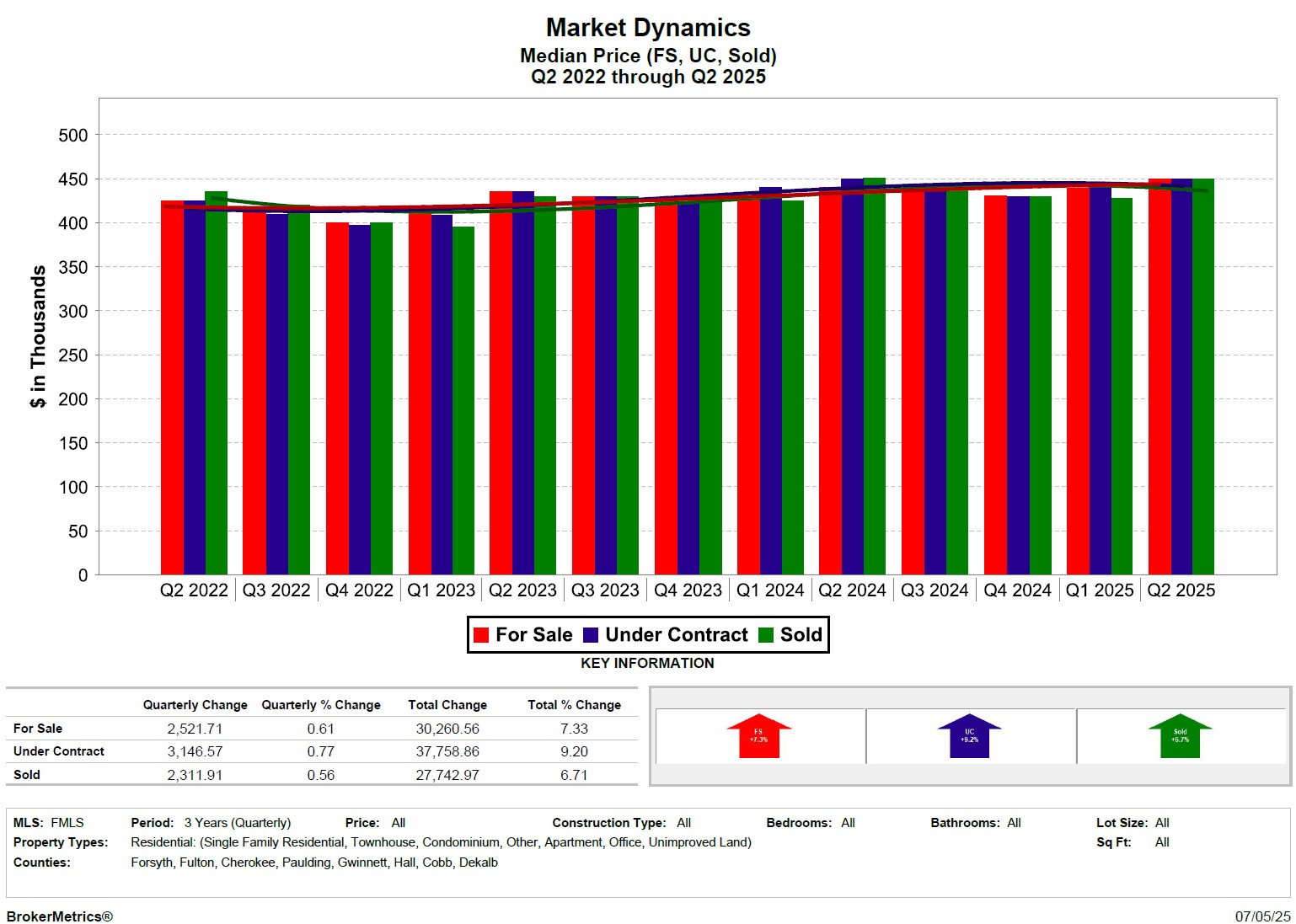

Home Prices in Atlanta

- YOY list prices were +2.3% and contract and sale prices were level

- 3 year trends are very strong despite seasonal peaks and valleys

- Q2'25 is a peak for median contract and sale prices - $450K

- Context - Prices are not collapsing, expect 1%-3% broadly over the next year

And What This Means...

The homework assignment is to get familiar with the word BALANCED. That is where we are overall; of course micro markets might be different - and that's what a skilled agent provides. In the mean time, three main takeaways:

- Sellers - It's not '21-'22, rates are not 3%, you will not have 10 offers on your home in an hour. Price it appropriately.

- Buyers - Rates below 6% are not coming back, prices are not crashing, it "won't be cheaper to buy" next year.

- Get Educated - This industry changed more in the last year than in the last fifty. If you don't do your due diligence, you will pay.

Take a breath, use your head, and remember that ALL real estate is local.

The Hank Miller Team puts 35+ years of full time sales & appraisal experience to work for you. Act with complete confidence & make sound, decisive real estate decisions.

678-428-8276 and info@hmtatlanta.com

Posted by Hank Miller on

Leave A Comment