“Why didn’t mortgage rates drop when the Fed cut the discount rate?” A simple question with so many variables that even experts can’t agree. The focus seems to always be on “the Fed”; how does all of the economic news impact decisions made by the Federal Reserve? Through most of 2024, all eyes were on the Fed as everyone wondered if they would cut rates. They finally did in Sept and again in Nov…and mortgage rates, well, they remain about where they were. So, what happened? But, did anyone (other than the disingenuous media) really think rates were getting into the 5's or lower? No one here, nor anyone associated with legitimate real estate organizations, did.

“Why didn’t mortgage rates drop when the Fed cut the discount rate?” A simple question with so many variables that even experts can’t agree. The focus seems to always be on “the Fed”; how does all of the economic news impact decisions made by the Federal Reserve? Through most of 2024, all eyes were on the Fed as everyone wondered if they would cut rates. They finally did in Sept and again in Nov…and mortgage rates, well, they remain about where they were. So, what happened? But, did anyone (other than the disingenuous media) really think rates were getting into the 5's or lower? No one here, nor anyone associated with legitimate real estate organizations, did.

The Fed & Rates

The Federal Reserve does not directly set mortgage rates. When the Fed raises or lowers the federal funds rate, it directly affects the cost of borrowing for banks, which in turn influences the rates banks charge businesses, consumers, and each other. Think of the Fed as a "business to business" organization; they work a few levels above consumers. Lower rates often encourage borrowing, while higher rates aim to curb inflation. In March of ’22 with inflation out of control, the Fed raised rates for the first time since 2018. That continued through July ’23 as inflation peaked at 9.1%, as they attempted to tame spending and inflation. The inflation wildfire was so robust that the Fed made history, the most rate increases in the shortest span of time ever. Inflation continues to be an annoyance, but the worst appears to be in the rear view.

What the Fed Considers

There are a significant number of variables considered by the Fed before they act. All of us are familiar with the two most obvious…

- Economic Conditions – the world is a small place, global economic conditions impact our economy.

- A robust economy tend to push consumers to spend, as demand increases so does the cost of borrowing. In weak economies, lowering rates can provide the boost consumers need to get moving.

- Bonds - rates are closely tied to yields on U.S. Treasury bonds and mortgage-backed securities. When bond yields rise, mortgage rates tend to follow, as investors demand higher returns.

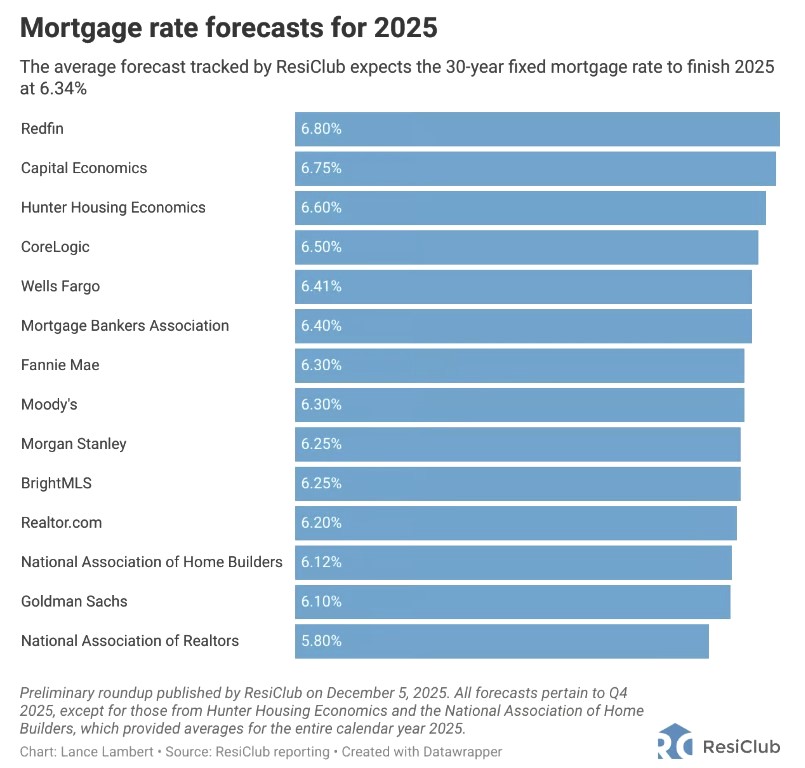

The first impression of the new administration seems very positive, so where should we expect rates to be over this coming year? It’s best to consider multiple opinions, it’s reasonable to say ranging between 6.25% and 6.75%. This is an excellent chart from ResiClub.

We learned over the last many years that everyone is an expert, and no one is an expert. Safe to say, it’s best to look maybe a quarter ahead as so many variables are in play. Be aware of economic conditions, how the Fed works and how this impacts mortgage rates. Aware is the key term, this is not our area of expertise. Best to leverage your professional lender resources to provide clients with the best advice. Things are normalizing, but one thing we professionals know is to be ready for anything.

The Hank Miller Team puts 35+ years of full time sales & appraisal experience to work for you. Act with complete confidence & make sound, decisive real estate decisions.

678-428-8276 and info@hmtatlanta.com

Leave A Comment